PropNex Picks

|January 03,20252025 New Year's Resolution: Saving for a Home

Share this article:

New year, new goals! It's officially 2025, which means it's time to make some resolutions! Instead of making the same old resolutions like "stop mindless scrolling on TikTok" (we all know that's not happening), why not do something that can truly change your life?

That's right, 2025 shall be the year we all start saving for a home. Whether you're planning to buy your first property or upgrade to a better one, you'll thank yourself for sticking with this resolution when you finally have the keys to your next home. So here are some tips and tricks to get you started!

The first and perhaps the most crucial step to saving is budgeting. It's practically your financial blueprint. I know it sounds tedious at first, but you really only need to set it once. Then, as time goes on, you can tweak as needed. Once you've mapped out where your money is going, it'll be easier to keep everything on track.

Generally speaking, following the 50-30-20 rule can help you allocate your monthly earnings (minus any taxes) optimally. Here's the breakdown.

- 50% of your money goes to needs. What counts as a need? Well if you can't live without it, then it's a need. So this would entail things like rent, food, groceries, transport, and even credit card bills.

- 30% of your money is for wants. This could be your Netflix subscription, online shopping, hobbies, or vacation.

- The remaining 20% should go to savings. That means emergency funds, contributions to your CPF, and money for your dream home.

If you want to move things along, you can always change the ratio. For example, allocate 30% or more on savings and cut down on your wants.

It also helps to track your expenses (and I mean ALL of them). From your morning kopi to the impulsive Shopee check outs. There are many tracker apps available, or you can go old-school with an Excel sheet. This way, you'll get a clear picture of where your money is going and you'll be able to reevaluate your spendings. Like, do you really need another Labubu in your collection? Are you actually going to use it or will it just collect dust on the shelf?

It's always good to cut unnecessary costs, but at the same time, don't take out the joy in your life. Figure out what works for you without sacrificing too much. When you keep things realistic, you're more likely to stick within the budget.

If you're like me and you lack self control, then do yourself a favour and open a dedicated savings account. It's easier to resist all the worldly temptations when you keep your home fund separate. I suggest opening a high-interest savings account and setting up automatic transfers to "force" yourself to save. And throw away the ATM card that comes with it! Some accounts reward you with higher interest rates when you credit your salary or meet certain transaction criteria, so check with your banks. And here's a hack: label your account "Dream Home Fund" for an extra psychological push.

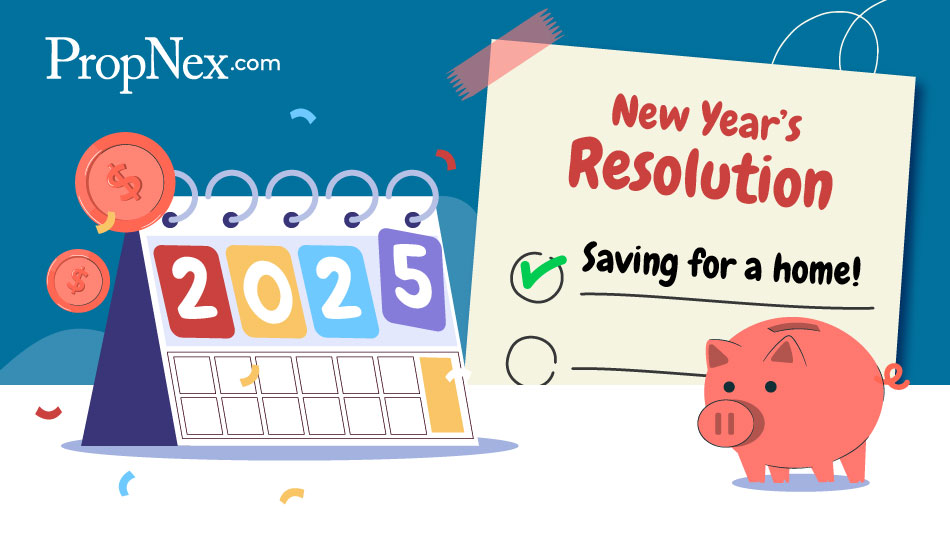

Do you have credit card debts or student loans? Perhaps you're still paying off that new iPhone you just bought? Well, these monthly payments are eating into your ability to save, so it's important that you manage your debt. There are two ways you can do this:

Whichever method you choose, stick to it. The less debt you have, the more you can allocate towards your dream home.

You're probably already aware that you can tap into your Central Provident Fund (CPF) to purchase a home, but just in case you're not sure how to make the most out of it, I've got you covered. Here's a rundown to get you started.

Basically, your CPF is divided into four accounts:

- Ordinary Account (OA): Crucial for home financing! You can use this for your flat's down payment, monthly mortgage, and even housing grants.

- Special Account (SA): Think of this as your piggy bank for retirement. It grows at a higher interest rate but isn't directly linked to housing. Sadly, this service will be closed starting from the second half of January 2025.

- Medisave Account (MA): This account is reserved for your healthcare needs, so you cannot use it for housing.

- Retirement Account (RA): This account will be created for you once you turn 55. You can get monthly retirement payouts from it.

For housing needs, you're mainly going to rely on your OA. Whether it's for an HDB flat or private property, your OA can cover your down payment, housing loan repayments, stamp duties, and legal fees. If you're building a private property, you can also use your OA to finance construction loans or purchase vacant land.

However, there are limits to how much of your OA you can use for your property, so definitely use the housing usage calculator to get an estimate. The CPF board also recommends using a balanced mix of cash and OA for your housing expenses, leaving some funds in your OA to earn interest.

Speaking of growing your money, there is a little-known trick that might interest you, which is the CPF Investment Scheme (CPFIS). This programme allows you to invest your OA and SA savings into a variety of options like stocks, unit trusts, or even bonds.

With the CPFIS-OA, you can use your OA for investing purposes once you've set aside $20,000 in your account. You can allocate up to 35% of your investible savings (that means your current OA balance + any CPF amount already withdrawn for investment and education) into stocks and 10% into gold. With the CPFIS-SA, you can start investing once you've kept a minimum of $40,000 in your account. That said, please understand that any investment comes with risks, so make sure you know what you're doing before you jump right into it.

And don't forget that your CPF is all about securing your retirement, so tapping into it for your property means taking away from those future savings. That's why when you sell your home, you'll need to return the amount you used plus any interest it would've earned, to top up your retirement funds.

If you want to learn more about CPF, give this a read: 10 Essential Tips When Utilising Your CPF for Home Purchases

One perk of being a Singaporean is that you have a number of housing schemes and grants right at your fingertips, especially if you're a first-time buyer. So if you're planning to get an HDB flat, do take the time to get familiar with the different subsidies you are entitled to. And believe me when I say they can be a huge help. For example, with the recent Enhanced CPF Housing Grant (EHG) revision, you can receive up to $120,000 in grant amount. Click here to read up more on this topic so you can maximise these benefits when the time has come to buy a house.

Saving for a home might sound like a big commitment, but it's the start of a new year and there's no better time to level up your life. Set up a clear budget, manage your debts, take advantage of your CPF, and most importantly, commit to self-development. With discipline and a clear plan, 2025 could be the year you take the first step towards your dream home.

Another good tip is to get Kelvin Fong's new book, Property Wealth System Vol 2: Elevate Your Assets, Elevate Your Wealth. It's a guide on how you can create wealth safely, packed with insights on tackling fears, understanding the market, and making confident investment decisions. So are you ready to turn your resolution into reality?

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.